1099r distribution box 1 Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a .

If anyone is hunting for the junction of the 7 way plug cable and the trailer wiring in a 2016 North Point, most likely Pinnacle too. You won't find an actual junction box. They are wire nutted up behind the hitch light.

0 · form 1099 r gross distribution

1 · form 1099 r distribution

2 · form 1099 r check box

3 · form 1099 r box 2b

4 · 1099 r pension distribution

5 · 1099 r ira distribution code

6 · 1099 r form box 3

7 · 1099 r distribution code

The N080-SMB1-WH Single-Gang Surface-Mount Junction Box is perfect for mounting a wallplate to complete multiple audio/video, voice and Ethernet in-wall connections using any type of keystone jack, including Cat5e/6/6a, USB, HDMI, DisplayPort and RCA.

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.File Form 1099-R for each person to whom you have made a designated distribution .

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From .

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. . Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a .

For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a. You should also receive a statement indicating the .

Distributions from a Roth IRA may be tax-free. You'll automatically receive Form 1099-R if you took at least in distributions from a relevant source. When tax season rolls .

Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the .

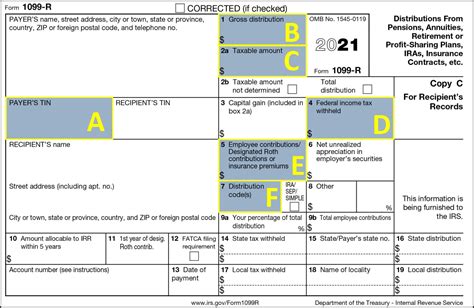

The image below highlights the 1099-R boxes most frequently used—and their explanations—for defined contribution plan distributions. . (as opposed to Code 8 with the .If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement plans, any individual .File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans.

form 1099 r gross distribution

Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution.

form 1099 r distribution

1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable. For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a. You should also receive a statement indicating the value of each bond at the time of distribution. Distributions from a Roth IRA may be tax-free. You'll automatically receive Form 1099-R if you took at least in distributions from a relevant source. When tax season rolls around, you'll probably receive a handful of documents. Form 1099-R might be among them. Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

The image below highlights the 1099-R boxes most frequently used—and their explanations—for defined contribution plan distributions. . (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death)If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement plans, any individual .

File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs). Annuities, pensions, insurance contracts, survivor income benefit plans. Box 1 - Gross Distribution shows the total or gross amount that was distributed to the taxpayer this year. The amount may have been a direct rollover, a transfer or conversion to a Roth IRA. It also may have been received as a periodic payment, a non-periodic payment, or as a total distribution. 1099-R Box 1: Gross Distribution. This box identifies the amount of distribution from a retirement plan or annuity. The number is identified in a gross dollar amount. There are many factors that will impact whether this amount is taxable on non-taxable.

For redeemed United States savings bonds, Box 1 will contain the value of bonds distributed from a plan. The taxable amount of redeemed bonds should appear in Box 2a. You should also receive a statement indicating the value of each bond at the time of distribution. Distributions from a Roth IRA may be tax-free. You'll automatically receive Form 1099-R if you took at least in distributions from a relevant source. When tax season rolls around, you'll probably receive a handful of documents. Form 1099-R might be among them.

electric box para android

Like other 1099s, a 1099-R divides information into two sections. On the left side of the form are boxes for . Here are the boxes on the right side of the form. Box 1. Gross distribution from the plan.

electric box panel outdoor

Box 1 reports the total amount of distribution from a retirement plan or annuity, this is the gross amount of dollars you received from the plan. It may be taxable or not depending on many factors. Box 2 reports the taxable amount of the distribution as reported by the payer.

form 1099 r check box

The TRINITY 66 in. x 19 in. Stainless Steel Rolling Workbench provides all your garage, basement, or kitchen storage needs. The drawer layout accommodates large and small tools, and the drawers have 100 lb. weight capacity ball-bearing slides for easy access.

1099r distribution box 1|1099 r ira distribution code