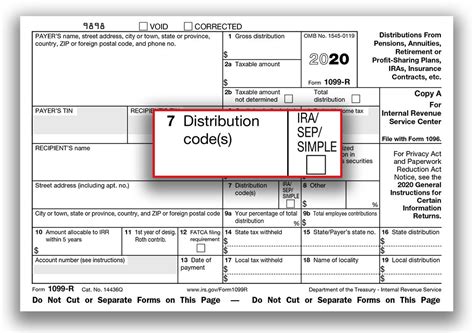

distribution code box 7 is 04 Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.

North Carolina Barndominums & Metal Building Homes The latest real estate listings for metal buildings in North Carolina. From the mountains in Asheville to coast in Wilmington, we feature .

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

$17.95

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your .

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply .

artists metal paint boxes

The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form . This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal . Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code.

pension distribution codes

Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another . Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each.

The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax return This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated .

Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account. By knowing what each code means, you can accurately report your distribution on your tax return. .

Use code 7, Normal distribution, when the IRA owner or plan participant is age 59½ or older (use code 1 if the individual is age 59½ or older but modified a series of substantially equal periodic payments before five years).Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or endowment contract and for .

as/nzs big junction box factories

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. The Distribution Code Table below refers to the entries on Form 1099 in Box 7. Detailed overview, instructions of Form 1099-R and 5498 Instructions on how to enter Form 1099-R on your tax return This chart clearly identifies the distribution codes for Box 7 of form1099-R, which helps note the type of distribution you received, and what they all mean. . Code 7: Normal distribution. The distribution is after age 59 1/2. B (Designated .

Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

irs roth distribution codes

irs pension distribution codes

If a 1099-R has more than 1 distribution code in Box 7, you'll need to determine which code should be applied to give the correct tax treatment, then only enter that code. Distribution codes in Box 7 of Form 1099-R tell the IRS what type of distribution you received. These codes indicate if the distribution is subject to early withdrawal penalties, exempt from penalties, or rolled over into another account. By knowing what each code means, you can accurately report your distribution on your tax return. .

as sheet metal

ira normal distribution 7

Make your quilt shine bright with gorgeous metallic fabrics! Great prices & selection of metallic fabric by the yard & precut fabrics in every color & theme.

distribution code box 7 is 04|irs roth distribution codes