how to report taxable 1099-div box 3 nondividend distribution income We would like to show you a description here but the site won’t allow us. Handmade from T-304 premium stainless steel this modern kitchen sink looks striking in any space. Clean lines and thoughtful design details highlight the elegance of its finishes, for an eye-catching look with contemporary appeal.

0 · non dividend distributions 1040

1 · non dividend distributions

2 · intuit 1099 box 3

3 · box 3 non dividend distributions

4 · 1099 non dividend distribution

5 · 1099 box 3 nondivided distribution

6 · 1099 box 3 non dividend

7 · 1099 box 3 distributions

Uniteam CNC machining centers are renowned for their exceptional precision and accuracy. With advanced features like automatic tool changers, tool length measurement systems, and laser calibration, these machines ensure consistently accurate results, even on .

1 Best answer. Hal_Al. Level 15. Non dividend distributions do not go anywhere on your actual tax return. Box 3 is for your information. Box 3 is a "return of capital". That is, you have been given back part of your original investment.1 Best answer. Hal_Al. Level 15. Non dividend distributions do not go .

TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .We would like to show you a description here but the site won’t allow us.You can find your nontaxable distributions on Form 1099-DIV, Box 3. They’re uncommon. How to Calculate Nondividend Distributions. Reduce your basis in .

See section 853A. Report bond tax credits distributed by a RIC or REIT on Form 1097-BTC. If a RIC or REIT distributes any credits with respect to its stock, the RIC or REIT must report the .

The IRS instructions for Form 1099-DIV Box 3, found on Page 5, will tell you much the same thing: https://www.irs.gov/pub/irs-access/f1099div_accessible.pdf. Another way of .

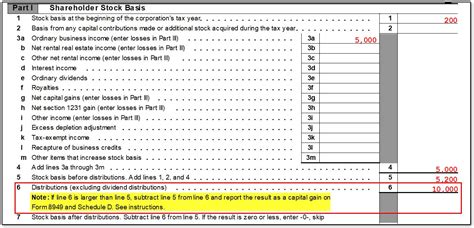

If a shareholder receives a Form 1099-DIV completed with Box 3 for nondividend distributions, the taxpayer received a distribution of property that exceeds the corporation's .Dividends. If you make a payment that may be a dividend but you are unable to determine whether any part of the payment is a dividend by the time you must file Form 1099-DIV, the . Nondividend distributions (Box 3): These are returns of capital that aren’t taxable but can affect your cost basis in the investment. Federal income tax withheld (Box 4): If your broker withheld federal taxes on your dividends, that .

When you receive a Form 1099-DIV that has an amount for Box 3, Nondividend Distributions, you may be wondering where to report it. IRS Publication 550, page 21 states .You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a nondividend distribution will be shown in box 3. If you do not receive .

Any liquidating distribution you receive isn't taxable to you until you've recovered the basis of your stock. After the basis of your stock has been reduced to zero, you'll report the liquidating .

Check the box if you are a U.S. payer that is reporting on Form(s) 1099 (including reporting distributions in boxes 1 through 3 and 9, 10, 12, and 13 on this Form 1099-DIV) as part of satisfying your requirement to report with respect to a U.S. account for the purposes of chapter 4 of the Internal Revenue Code, as described in Regulations . If you were to receive a 1099-DIV statement, with an amount printed in Box 3 (non-dividend distribution), then you could certainly type that number into the TurboTax data entry screen for the 1099-DIV tax form . . . but it won't actually do anything.

Income tax compliance; Tax automation; Tax compliance; Tax planning; Tax preparation; Tax tools; . A nondividend distribution is a distribution that's not paid out of the earnings and profits of a corporation. Any nondividend distribution is not taxable until the basis of the stock is recovered; however, a record needs to be maintained .There's a tiny box that needs to be checked on the 1099-DIV screen. (See the attached screenshot below. Click to enlarge.) First, how to get there; then a little info below on why Box 8 and 9 is usually not taxable.. 1. With your tax return open, search for 1099-DIV or 1099DIV (lower-case works also) and then click or tap the "Jump to" link in your search results.

Nondividend Distributions - Report any amounts in excess of your basis in your mutual fund shares on Form 8949. Use Part II if you held the shares more than 1 year. . You should receive a Form 1099-DIV or other statement showing you the nondividend distribution. On Form 1099-DIV, a nondividend distribution will be shown in box 3. If you do . Non-taxable distributions typically find their place in Box 3 of Form 1099-DIV under the “Non-Dividend Distributions” column. Investors may receive this form from the distributing company. IRS Publication 550 provides detailed information on reporting requirements for investment income, including non-dividend distribution income.

non dividend distributions 1040

On Form 1099-DIV, a nondividend distribution will be shown in box 3. If you do not receive such a statement, you report the distribution as an ordinary dividend. Report nondividend distributions (box 3 of Form 1099-DIV) only after your basis in the stock has been reduced to zero. Notably missing are Boxes 9 and 10 of the 1099-DIV which report Cash & Noncash Liquidation Distributions, respectively. I do a lot of 1041 trust returns. Comparing the the 1099-DIV worksheet in the 1041 to the Dividend Income Worksheet in the 1040 returns, you'd think these two returns were developed on tow completely different planets. The .If your total dividends and interest exceed ,500, you may need to file a Schedule B with your tax return to report this income. 1099-DIV reporting boxes. Box 1a of your 1099-DIV will report the total amount of ordinary dividends you receive. Box 1b reports the portion of box 1a that is considered to be qualified dividends. Enter the ordinary dividends from box 1a on Form 1099-DIV, Dividends and Distributions on line 3b of Form 1040, U.S. Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return.; Enter any qualified dividends from box 1b on Form 1099-DIV on line 3a of Form 1040, Form 1040-SR or .

okay, so I've contacted TD Ameritrade regarding my 1099-DIV and box 3 where there's a value for the nondividend distribution and was told that because I had sold the security almost within the same time frame as receiving the dividend that it's considered a capital gain since they were not able to adjust the cost basis of the security. that said, any idea where to actually report this?According to IRS Publication 550: Investment Income and Expenses of the United States: You should get a Form 1099-DIV or similar document indicating the non-dividend distribution. A non-dividend distribution will be noted in box 3 on Form 1099-DIV. If you do not get such a statement, the distribution is reported as an ordinary dividend. Box 4 reports any federal income tax withheld from your dividend payments. Withholding can occur for various reasons, like failing to provide a Social Security number. This withholding can help offset your overall tax liability when you file your return. Reporting Dividends and Distributions: How to File Form 1099-DIV. When filing your tax .Paper filing deadline: February 28th If you are filing Form 1099-DIV with the IRS using traditional paper methods, the deadline is earlier – February 28th of the year following the tax year for which the form is being issued.; Recipient copies deadline: January 31st. Payers are required to provide copies of Form 1099-DIV to the recipients by January 31st of the year following the tax year .

Non-taxable distributions are generally reported in Box 3 of Form 1099-DIV. Return of capital shows up under the “Non-Dividend Distributions” column on the form. The investor may receive this .The IRS 2019 Publication 550 says: Nondividend distributions (Form 1099-DIV, box 3) Generally not reported* (Table 1.1). . It will not impact your tax return (it's just reporting information). In your information you'll track that your basis is now 0 for that lot of shares (K - 0 ROC). If you sell the shares at , you're gain will .This is a pickle. I didn't receive a 1099-DIV from my broker because I made less than for the whole year (around ). So, in order to report it, I have to go off of my account summary. All it shows me is how much dividends I got throughout the whole year, not broken down by type or whatnot. My account summary isn't very detailed in that regard.

tinsnips metal fabrication

Customer: how do I report nondividend distributions from Box 3 of a 1099 DIV. Accountant's Assistant: What are you using the funds for? It can help in determining whether there will be a penalty or not. Customer: These distributions are on a 1099 DIV from a mutual fund. Accountant's Assistant: How old are you? How long did you contribute to your retirement plan? The brokerage account 1099-DIV included the non-dividend distribution in Box 3 and I reported as such when I entered the brokerage account information into Turbotax. There is no option for reporting the excess distribution via the 1099-DIV options in Turbotax that I .3 . Nondividend distributions $ 4 . Federal income tax withheld $ 5 . Section 199A dividends $ . State income tax withheld reporting boxes. Nominees. If this form includes amounts belonging to another person, you are . with the IRS for each of the other owners to show their share of the income, and you must furnish a Form 1099-DIV to each .

A Form 1099-DIV or other statement showing the nondividend distribution should be issued to the taxpayer. On Form 1099-DIV, a nondividend distribution will be shown in box 3 and generally is not taxable. If you do not receive such a statement, you report the distribution as an ordinary dividend. Basis adjustment. Nondividend distributions (Box 3): . Federal income tax withheld (Box 4): If your broker withheld federal taxes on your dividends, that amount will show up here. (Any state taxes withheld show up in Box 14.) . If you don’t report your 1099-DIV income, the IRS might come knocking, asking for the tax you owe, . Box 3 reports nondividend distributions that occur when an investment you own returns assets to you that are not profits. For example, if you receive additional shares in a company due to a stock split. . For your federal income tax return, you will use the information on Form 1099-DIV to report your dividend income on either your Schedule B .Find the amount in box 3 of Form 1099-DIV and subtract that amount from the total basis of your shares. If you’re using the separate lot method to determine your basis, you’ll need to take a few more steps: Start with the amount in box 3 of Form 1099-DIV. Divide that figure by the number of shares to which it applies.

You should input your Form 1099-DIV form into TurboTax exactly how it appears. Total Capital Gains Distributions from 1099-DIV Box 2a are included as taxable income even though they are reinvested. They add to the cost basis of your mutual fund and will come in to play when you sell your shares. Explore tax tools, get tips, and read reviews. . Where do I enter dividend income received without having a 1099-DIV form? . Do I need to amend my return to reflect a non dividend distribution in Box 3 on a just received amended .Income tax compliance; Tax automation; Tax compliance; Tax planning; Tax preparation; . To track liquidating distributions from a 1099-DIV, access the . Record of nondividend and liquidating distributions. window on the . Info. screen in the . General. folder. .

tin snips cutting sheet metal

It's showtime!/Metal Crusher - Metal Crusher (Undertale) Sheet music for .

how to report taxable 1099-div box 3 nondividend distribution income|1099 non dividend distribution