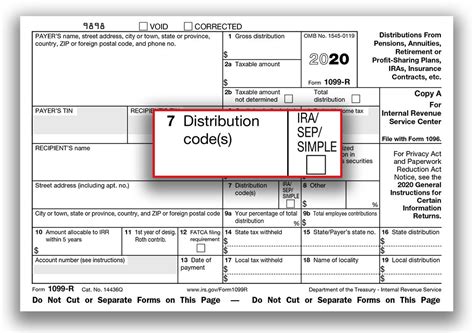

distribution code t in box 7 A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to . $6,700.00

0 · pension distribution codes

1 · irs roth distribution codes

2 · irs pension distribution codes

3 · ira normal distribution 7

4 · box 7 code 4

5 · box 7 1099 r

6 · 1099 r 7d distribution code

7 · 1099 box 7 code 6

Descubra aspectos importantes da usinagem CNC de aço inoxidável. Procure conselhos sobre ferramentas a serem usadas, configurações e situações. Precisa de peças de usinagem CNC .

A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax free) distribution .

A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to .TurboTax is here to make the tax filing process as easy as possible. We're .Find TurboTax help articles, Community discussions with other TurboTax users, .

We would like to show you a description here but the site won’t allow us. As your distribution is not taxable, Code T in the 1099-R for a Roth IRA distribution means that there is an exception. What do all the codes in Box 7 of the 1099-R mean? The .The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth .

These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 . One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply . Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, .Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early .The code in box 7 is "T," and the IRA/SEP/SIMPLE box is NOT checked. I did see that the T code was probably causing a problem and I don't know why my broker used it so I will discuss this with them. However, I think the Turbotax questions . A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax .

As your distribution is not taxable, Code T in the 1099-R for a Roth IRA distribution means that there is an exception. What do all the codes in Box 7 of the 1099-R mean? The code (s) in Box 7 of your 1099-R helps identify the type of distribution you received.

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. UThese distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable.

pension distribution codes

One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.

Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;The code in box 7 is "T," and the IRA/SEP/SIMPLE box is NOT checked. I did see that the T code was probably causing a problem and I don't know why my broker used it so I will discuss this with them. However, I think the Turbotax questions following 1099-R . A code T 1099-R is reporting a distribution from a Roth IRA that is not subject to early withdrawal penalty but the financial institution issuing the 1099-R does not know if the 5-year holding period to make the distribution a qualified (and therefore entirely tax .

As your distribution is not taxable, Code T in the 1099-R for a Roth IRA distribution means that there is an exception. What do all the codes in Box 7 of the 1099-R mean? The code (s) in Box 7 of your 1099-R helps identify the type of distribution you received.The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty.T. Roth IRA distribution, exception applies. Use Code T for a distribution from a Roth IRA if you do not know if the 5-year holding period has been met but: The participant has reached age 59 1/2, The participant died, or The participant is disabled. Note: If any other code, such as 8 or P, applies, use Code J. None. U

These distributions are reportable on Form 1099-R and are generally taxable in the year of the distribution (except for excess deferrals under section 402(g)). Enter Code 8 or P in box 7 (with Code B, if applicable) to designate the distribution and the year it is taxable. One of the most difficult aspects of reporting IRA and retirement plan distributions is determining the proper distribution code(s) to enter in Box 7 on IRS Form 1099-R. We’ve called out each distribution code that may apply and explained when to use each. Box 7 of IRS Form 1099-R is used to indicate the distribution code that corresponds to the type of distribution you received from a retirement plan, which determines whether it’s a taxable or non-taxable event.Box 7 of 1099-R identifies the type of distribution received. These codes descriptions are taken directly from the back of form 1099-R. Early distribution, no known exception (in most cases, under age 59½). Early distribution, exception applies (under age 59½).

Are you filing a Form 1099-R for your client? Find the explanation for box 7 codes here. (1) Early distribution (taxpayer is under age 59-1/2) and there is no known exception to the early distribution penalty. Generally file Form 5329, however for a rollover to a traditional IRA of the entire taxable part of the distribution, do not file Form 5329;

irs roth distribution codes

12 x 124 stainless steel sheet metal

12 x 12 x 4 electrical enclosure

irs pension distribution codes

Centros de usinagem CNC para elementos de madeira maciça são máquinas projetadas para processar elementos de formas complexas em madeira curva ou madeira maciça.

distribution code t in box 7|pension distribution codes