box 6 1099-r distribution codes If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7. Is there a minimum device box size for GFCI's? I have an old house and the device box is damn small - so small I almost have to smash with my hand to get the GFCI to fix in the box. I want to replace the box with a larger size so the GFCi fits nice and the conductors are not crushed/smashed as well.

0 · what's 1099 r code explanations

1 · irs 1099 r taxable amount

2 · 1099 r payer id number

3 · 1099 r instructions for recipient

4 · 1099 r incorrect distribution code

5 · 1099 r distribution codes meaning

6 · 1099 r code 6 taxable

7 · 1099 r account number instructions

You can obtain the top-notch education and training necessary for a fulfilling lifetime career in one of North America’s fastest-growing industries through our extensive network of 148 sheet metal industry training centers.

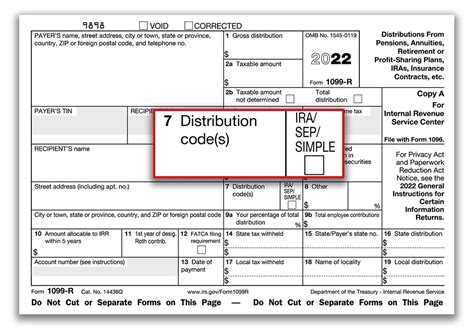

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Information about Form 1099-R, Distributions From Pensions, Annuities, .Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From .Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom .

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your . Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. However, this tax form serves many purposes besides simply reporting retirement .

Box 6 - Net unrealized appreciation in employer's securities shows the taxpayer received a distribution of employer's securities (stock) from a qualified pension plan. This amount is included in box 1, but not included in .Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding.

what's 1099 r code explanations

Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a .Go to the IRS Instructions for Forms 1099-R and 5498, page 15, to view Table 1. Guide to Distribution Codes. Scroll down to the Box 7 section, and click Guide to distribution codes, or . When you receive a Form 1099-R for a retirement or pension distribution, you’ll notice that Box 7 contains a distribution code. These distribution codes are essential for .

This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early .

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirementThe code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. However, this tax form serves many purposes besides simply reporting retirement benefits. In this article, we’ll walk through IRS Form 1099-R, including: Let’s start with a step by step look at IRS Form 1099-R.

Box 6 - Net unrealized appreciation in employer's securities shows the taxpayer received a distribution of employer's securities (stock) from a qualified pension plan. This amount is included in box 1, but not included in box 2a, and it represents the appreciation in the stock value that occurred since the original contribution of stock.Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding. Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a complete list of codes and their meanings, see Table 1 in the IRS Instructions for Forms 1099-R and 5498 .

Go to the IRS Instructions for Forms 1099-R and 5498, page 15, to view Table 1. Guide to Distribution Codes. Scroll down to the Box 7 section, and click Guide to distribution codes, or Distribution code combinations. When you receive a Form 1099-R for a retirement or pension distribution, you’ll notice that Box 7 contains a distribution code. These distribution codes are essential for understanding how your distribution will be taxed and if there are any additional penalties. Let’s break down these codes to help you understand what each one means and how it impacts . This code indicates the monies are taxable in a prior tax year (as opposed to Code 8 with the distribution taxable the year of the 1099-R form). 1 (Early Distribution) 2 (Early Distribution—not subject to 10% early distribution tax) 4 (Death) B (Designated Roth) Code U: Dividends distributed from an ESOP under section 404(k).

If an IRA conversion contribution or a rollover from a qualified plan is made to a Roth IRA that is later revoked or closed, and a distribution is made to the taxpayer, enter the gross distribution in box 1 of Form 1099-R. If no earnings are distributed, enter 0 (zero) in box 2a and Code J in box 7.

Specific Instructions for Form 1099-R. File Form 1099-R, Distributions From Pensions, Annuities, Retirement or Profit-Sharing Plans, IRAs, Insurance Contracts, etc., for each person to whom you have made a designated distribution or are treated as having made a distribution of or more from profit-sharing or retirement

The code(s) in Box 7 of your Form 1099-R helps identify the type of distribution you received. We use these codes and your answers to some interview questions to determine if your distribution is taxable or subject to an early withdrawal penalty. Taxpayers who take retirement distributions may receive IRS Form 1099-R in the January following the calendar year of their distribution. However, this tax form serves many purposes besides simply reporting retirement benefits. In this article, we’ll walk through IRS Form 1099-R, including: Let’s start with a step by step look at IRS Form 1099-R. Box 6 - Net unrealized appreciation in employer's securities shows the taxpayer received a distribution of employer's securities (stock) from a qualified pension plan. This amount is included in box 1, but not included in box 2a, and it represents the appreciation in the stock value that occurred since the original contribution of stock.

Regarding 1099-R distribution codes, retirement account distributions on Form 1099-R, Code 4 are taxable based on the amounts in Box 2a. Include the federal withholding amount reported in Box 4 as an additional withholding. Box 7: Distribution code(s) — This box has a code indicating the type of distribution, such as early withdrawal, normal distribution, or a Roth distribution. For a complete list of codes and their meanings, see Table 1 in the IRS Instructions for Forms 1099-R and 5498 .

irs 1099 r taxable amount

Go to the IRS Instructions for Forms 1099-R and 5498, page 15, to view Table 1. Guide to Distribution Codes. Scroll down to the Box 7 section, and click Guide to distribution codes, or Distribution code combinations.

When you receive a Form 1099-R for a retirement or pension distribution, you’ll notice that Box 7 contains a distribution code. These distribution codes are essential for understanding how your distribution will be taxed and if there are any additional penalties. Let’s break down these codes to help you understand what each one means and how it impacts .

cnc machine machine

1099 r payer id number

Whether you’re a MIG welder, a TIG welder, or want a machine you can do both with, we have reviewed a range of different welders to help you narrow down a good choice for your next project. 1. Miller Electric 211 – Best MIG Welder.

box 6 1099-r distribution codes|1099 r instructions for recipient